pay cheque calculator ontario

In Ontario those earning between 50000-99000 pay the highest share of provincial income tax. Your average tax rate is.

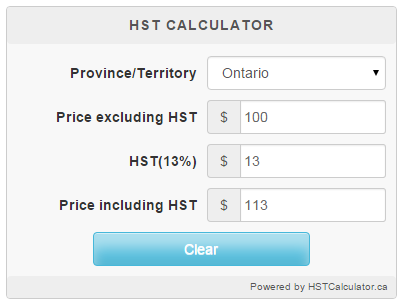

Ontario Hst Calculator 2020 Hstcalculator Ca

You first need to enter basic information about the type of payments you make.

. This tool will estimate both your take-home pay and income taxes. The tool then asks you. GetApp helps more than 18 million businesses find the best software for their needs.

It will confirm the deductions you include on your. The average monthly net salary in Canada is around 2 997 CAD with a minimum income of 1 012 CAD per month. Form TD1-IN Determination of.

How to use a Payroll Online Deductions Calculator. Ad Read reviews on the premier Paycheck Tools in the industry. This places Canada on the 12th place in the International Labour Organisation.

Just enter your annual pre-tax salary. The calculator is updated with the tax. The tool will convert that hourly wage into an annual salary.

Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Were making it easier for you to. GetApp helps more than 18 million businesses find the best software for their needs.

Income Tax Calculator Ontario 2021. Guide RC4110 Employee or Self-employed. The Ontario Annual Tax Calculator is updated for the 202122 tax year.

Guide RC4157 Deducting Income Tax on Pension and Other Income and Filing the T4A Slip and Summary. Net salary calculator from annual gross income in Ontario 2022 This net income calculator provides an overview of an annual weekly or hourly wage based on annual gross income of. Consult with an employment lawyer to seek legal advice about.

Ontario schools are now teaching income taxes to students between grades 9 and 12. Fill in the boxes below that apply to you to convert your actual pay or your payrate. If youd prefer to save that time to other activities even maybe activities more fun.

FICA contributions are shared between the employee and the employer. This severance calculator does not constitute legal advice and the results provide no guarantee of your entitlements. Use this simple powerful tool whether your.

For example imagine someone earns 15 per hour in Ontario works an average of 35 hours per week and has a total of 4 weeks of. Salary commission or pension. Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax.

The payroll calculator from ADP is easy-to-use and FREE. 62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62. The Employment Standards Act 2000 ESA is a law that sets minimum employment standards in most Ontario workplacesMost employees covered under the act.

Usage of the Payroll Calculator. If you pay a penalty or interest. Your average tax rate is.

Gross pay is what you make before any deductions are made taxes. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432That means that your net pay will be 40568 per year or 3381 per month. Were bringing innovation and simplicity back into the Canadian payroll market from new ways to pay your employees to our open developer program.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432That means that your net pay will be 40568 per year or 3381 per month. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for. Ad Read reviews on the premier Paycheck Tools in the industry.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. To calculate Stat Pay in Ontario is fairly straight forward even if it is time consuming. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits.

It is perfect for small business especially those new to payroll processing. The Ontario Income Tax Salary Calculator is updated 202223 tax year. 2021 free Ontario income tax calculator to quickly estimate your provincial taxes.

You can quickly calculate your net salary or take-home pay using the calculator above. You can use the calculator to compare your salaries between 2017 and 2022.

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

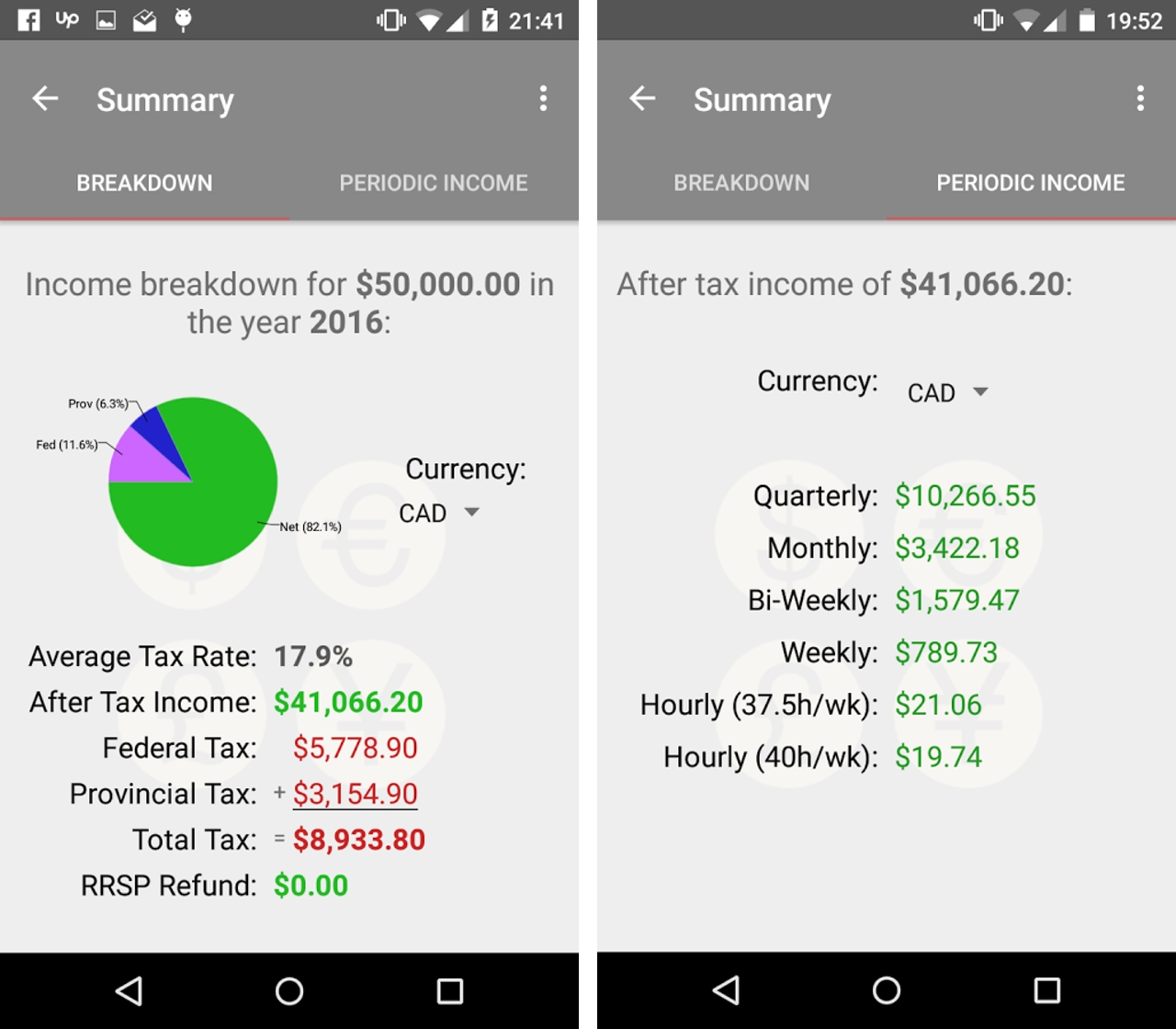

App Of The Week Canadian Net Income Calculator Mobilesyrup

Canadian Tax Brackets Marginal Tax Vs Average Tax Retire Happy

Paycheck Calculator Take Home Pay Calculator

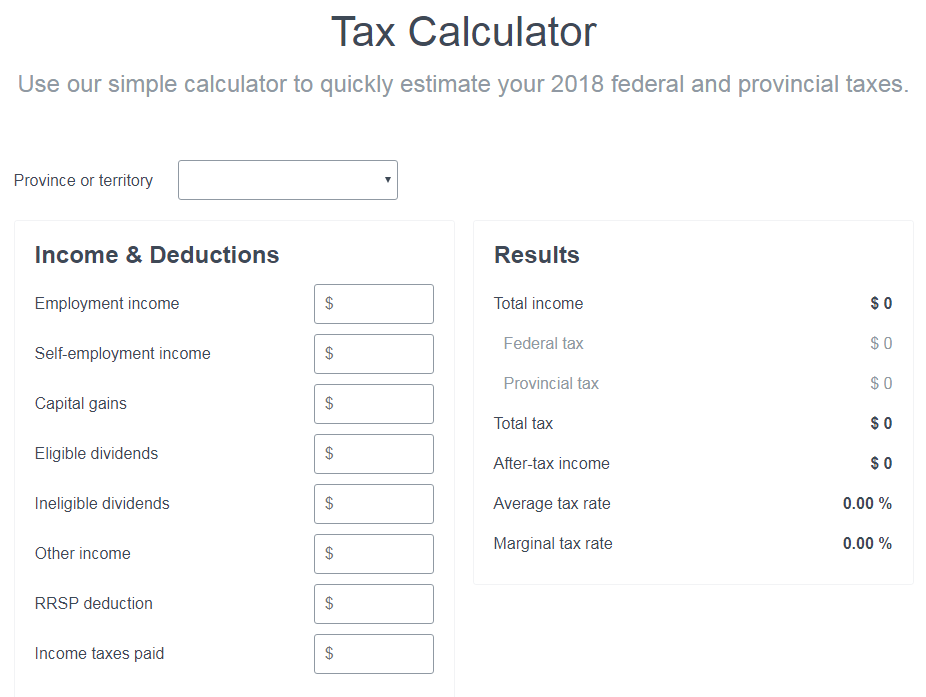

Income Tax Calculator Calculatorscanada Ca

0 Response to "pay cheque calculator ontario"

Post a Comment